The primary function of the Alton Assessor's Office is the annual assessment (as of April 1 of each year) of properties located within the Town to determine their market value for tax purposes.

Other functions performed in the assessor's office include:

- Continuous update of property owners' names and addresses;

- Tax map updates and verification of deed histories and sales research;

- Administration of timber and excavation taxes;

- Administration of current use program;

- Administration of tax credits and exemptions;

- The review and recommendations of Abatements;

The Value that Assessors strive for is market value. Market value is the most probable value. It is not the highest, lowest, or average price. It is expressed in terms of money. It implies a reasonable time for exposure to the market. It implies that both buyer and seller are informed of the uses to which the property may be put. It requires an arm's length transaction in an open market. It requires a willing buyer and a willing seller, with no advantage being taken by either buyer or seller. It recognizes the present use as well as the potential use of the property.

The Assessment Office handles applications for Tax Abatements. Abatement applications must be made to the Assessment Office in writing by March 1, after final notice of tax. The application then proceeds through local review and decision by the Board of Selectmen/women, with appeal rights to the Board of Tax and Land Appeals or to the Superior Court (on or before September 1, after final notice of tax).

RSA 79-D:2 III "Historic agricultural structure" means a barn or other structure, including the land necessary for the function of the building, currently or formerly used for agricultural purposes and as further defined by the advisory committee established under RSA 227-C:29.

As further defined by the Advisory Committee:

"Historic" shall mean agricultural structures, which are at least 75 years of age. Exceptions may be made for newer structures if they are considered to be of exceptional significance or importance.

An illustrative list of "agricultural structures" which might qualify for a discretionary preservation easement is provided in Attachment 1. Local governing bodies may decide to include other related agricultural structures in accordance with local circumstances.

"Barn" shall mean a building constructed to shelter livestock, equipment, feed, or other farm products. It may be freestanding, or connected to one or more other structures.

Guidelines:

In deciding whether to accept a discretionary preservation easement, RSA 79-D:3 establishes that the local governing body of the municipality shall determine whether the structure provides at least one of the following public benefits:

- There is scenic enjoyment of the structure by the general public from a public way or from public waters;

- It is historically important on a local, regional, state or national level, either independentaly or within a n historic district; or

- The structure's physical or aesthetic features contribute to the historic or cultural integrity of a property listed on or determined eligible for listing on the National Register of Historic Places, State Register of Historic Places, or locally designed historic district.

Applications must be filed at Assessment Office no later than April 15 of the tax year requested:

Current Use is the means for encouraging the preservation of open space and conserving the land, water forest, agricultural and wildlife resources.

Current Use acreage requirements consist of one of the following criteria: Tracts of Farmland, Forestland or unproductive land may qualify. You must have at least 10 acres or more land to qualify for current use assessment. A map establishing what sections of the land is to be in current use and under what categories, must accompany an applicaton.They are, Farmland, which needs a soil potential index, Forestland and unproductive land. These areas must exclude any buildings, appurtenance or other improvements on the land. Contact the Assessing Office for more details.

Further details may be obtained through the State of New Hampshire Current Use Criteria Booklet at the State of New Hampshire website.

Land Use Change Tax: RSA 79-A: 7

Land which has been classified as open space land (Farmland, Forestland and unproductive land) and assessed at current use values shall be subject to a land use change tax when it is changed to a use which does not qualify for current use assessment. Such as a development of a new home and/or less than 10 acres established from a sub-division of a different ownership.

The tax shall be at the rate of ten percent of the full and true value determined without regard to the current use values. Such value shall be determined as of the actual date of the change in use.

Personal: Applications must be filed at the Assessment Office no later than April 15 after final notice of tax.

- Veterans tax credit

- Elderly exemption

- Blind exemption

Exemptions/Credits:

Exemptions and Credits are available to residents of Alton. Any resident who may be eligible for an exemption for the first time must file a permanent application with the Assessing Department not later than April 15th of the current tax year.

Existing exemptions for veterans, blind and elderly will be continued automatically, based upon permanent applications already on file. Taxpayers must inform the Assessing Department of any change of status.

Disabled Veterans or widow of Disabled Veteran (RSA 72:35):

Any person who has been honorably discharged from the military service and who has a total and permanent service-connected disability, or the surviving spouse of such a person shall receive a yearly tax credit of $1,400 of property taxes on his residential property.

- Exemption: $1,400 reduction of total real estate tax bill

- Disability must be total and permanent service-connected injury (regardless of dates served)

- Principle Residency - must be property in Alton and you must be living at the residence as your permanent place

- Owner of the property on April 1st of application year

- Apply with copy of letter from Veterans Administration certifying 100% total and permanent disability

Veteran's or Veteran's Widow Credit (RSA 72:28):

- A credit of $500.00 from real estate tax bill

- Honorable discharge from service

- Applicant must apply with a copy of DD214 or equivalent

- To obtain a copy of your DD-214 go to: www.archives.gov/veterans/military-service-records

- Applicant must own property on April 1st of year of application

- NH resident for 1 year prior to April 1st of the application year

- Principle Residency - must be property in Alton and you must be living at the residence as your permanent place

- Notify Assessor's Office of any changes of address

Must be in armed service a minimum of 90 days during the following dates:

- April 6, 1917 and November 11, 1918 (extended to April 1, 1920 for service in Russia)

- December 8, 1941 and December 31, 1946 (including U.S. Merchant Marines)

- June 25, 1950 and January 31, 1955

- July 1, 1958 and December 22, 1961 if earned Vietnam service medal or expeditionary medal

- December 22, 1961 and May 7, 1975

- Vietnam conflict between December 22, 1961 to May 5, 1975 and July 1, 1958 to December 22, 1961

- Any other war or armed conflict that has occurred since May 8, 1975, if earned expeditionary medal or theater of operations service metal

- Gulf War if earned Liberation of Kuwait medal or Southwest Asia medal

NOTE: If you are receiving a Veterans Credit in any other Town, City or State, you are NOT eligible to receive the Veterans Credit in the Town of Alton.

Qualifying Awards for the Veterans Tax Credit

For Wars or Conflicts after May 8 1975

Any of the following medals shall be considered a "theater of operations service medal" for the purpose of qualifying a veteran for the Veterans Tax Credit in RSA 72:28:

- Armed Forces Expeditionary Medal

- Navy Expeditionary Medal

- Marine Corps Expeditionary Medal

- Southwest Asia Service Medal

- Kuwait Liberation Medal

- Kosovo Campaign Medal

- Global War on Terrorism Expeditionary Medal

In addition, in the absence of evidence to the contrary, the award of the following individual decorations shall also be considered evidence of a veteran's combat service and qualification for the Veterans Tax Credit:

- Air Force Cross

- Air Medal with "V" Device

- Army Commendation Medal with "V" Device

- Bronze Star Medal with "V" Device

- Combat Action Ribbon

- Combat Infantry Badge

- Combat Medical Badge

- Combat Aircrew Insignia

- Distinguished Flying Cross

- Distinguished Service Cross

- Joint Service Commendation Medal with "V" Device

- Medal of honor

- Navy Commendation Medal with "V" Device

- Navy Cross

- Purple Heart

- Silver Star

Current as of: 18 June 2004

The State Legislature passed (and Governor Benson signed into law) SB 531 with an effective date of July 23, 2004. This new law affects Veterans Property Tax Credit in RSA 72:28 by defining the term "theater of operations service medal" for any war or armed conflict that has occurred since 8 May 1975 as "any medal, ribbon or badge awarded to a member of the armed forces which establishes that the member served in a theater of war or armed conflict, as determined by the director of the state veterans council with written notification to the department of revenue administration. The purpose of this letter is to provide a list of those medals, ribbons or badges that qualify a veteran for the property tax credit.

Many people have asked how those military members who served (or are currently serving) in Afghanistan or Iraq will qualify for the tax credit. They will eventually be awarded the Global War on Terrorism Expeditionary Medal, which is on the list of qualifying awards. We plan to update the list as often as necessary to keep it current and accurate. If anyone has any questions or comments, please refer them to Dennis J. Viola, Director of the NH State Veterans Council at (603) 624-9230.

For information regarding Tax Deferrals for the elderly and/or disabled, please contact the Alton Assessing Office.

Fax: (603) 875-2163

In accordance with RSA 72 b, an "Intent to Excavate" application must be submitted to the Assessing Department before any Excavation can be started on any property within the Alton Town limits. An application may be obtained through the Assessing Department or through the State of New Hampshire Department of Revenue Administration. Further details can be obtained through the State of New Hampshire tax related statutes.

Abatement Forms, Elderly Exemptions, Veteran's Credit, and Current Use Forms can be printed at: http://www.nh.gov/btla/forms/index.htm

Assessing Forms |

|

|---|---|

| Change of Address Form |  |

The Assessment Office is the source of details of the status of April 1 of each year for each property's Real Estate Assessment. The Office also conducts local review of assessments appealed to the state. Additional information found at the Assessment Office includes:

- Assessment of current use land

- New construction/discoveries

- Sale reviews

- Changes in use/approvals resulting from Zoning Board of Adjustment and Planning Board

NET VALUATION ON WHICH THE TAX RATE IS COMPUTED: TOTAL ASSESSMENT $ 1,712,453,686

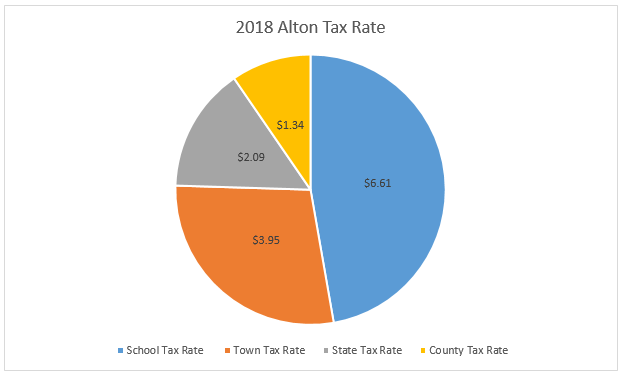

2018

Five Year tax rate history of Alton

| 2014 | 2015 | 2016 | 2017 | 2018 | |

| Town: | $3.85 | $3.57 | $3.90 | $3.73 | $3.95 |

| County: | $1.37 | $1.41 | $1.25 | $1.17 | $1.34 |

| School: | $6.28 | $6.94 | $6.66 | $5.88 | $6.61 |

| State Education: | $2.35 | $2.35 | $2.34 | $2.08 | $2.09 |

| TOTAL | $13.85 | $14.27 | $14.15 | $12.86 | $13.99 |

| ASSESSMENT RATIO | 99.6% | 98.0% | 97.5% | 99.0% | 92.7% |

| TAX RATE | $13.85 | $14.27 | $14.15 | $12.86 | $13.99 |

Looking for GIS? Click here to be redirected to our GIS web application.

Index

Alton01.pdf

Alton02.pdf

Alton02A.pdf

Alton03.pdf

Alton04.pdf

Alton05.pdf

Alton05-2.pdf

Alton06.pdf

Alton07.pdf

Alton08.pdf

Alton08-2.pdf

Alton09.pdf

Alton10.pdf

Alton11.pdf

Alton12.pdf

Alton12-2.pdf

Alton13.pdf

Alton14.pdf

Alton15.pdf

Alton16.pdf

Alton17.pdf

Alton18.pdf

Alton19.pdf

Alton20.pdf

Alton21.pdf

Alton21-2.pdf

Alton22.pdf

Alton23.pdf

Alton24.pdf

Alton25.pdf

Alton26.pdf

Alton27.pdf

Alton28.pdf

Alton29.pdf

Alton30.pdf

Alton31.pdf

Alton32.pdf

Alton33.pdf

Alton34.pdf

Alton35.pdf

Alton36.pdf

Alton37.pdf

Alton38.pdf

Alton39.pdf

Alton40.pdf

Alton41.pdf

Alton42.pdf

Alton43.pdf

Alton44.pdf

Alton45.pdf

Alton46.pdf

Alton47.pdf

Alton48.pdf

Alton49.pdf

Alton50.pdf

Alton51.pdf

Alton52.pdf

Alton53.pdf

Alton54.pdf

Alton55.pdf

Alton56.pdf

Alton57.pdf

Alton58.pdf

Alton59.pdf

Alton60.pdf

Alton61.pdf

Alton62.pdf

Alton63.pdf

Alton64.pdf

Alton65.pdf

Alton66.pdf

Alton66-2.pdf

Alton67.pdf

Alton68.pdf

Alton69.pdf

Alton70.pdf

Alton71.pdf

Alton72.pdf

Alton73.pdf

Alton74.pdf

Alton75.pdf

Alton76.pdf

Alton77.pdf

Alton78.pdf

Alton79.pdf

Alton80.pdf

Alton81.pdf

In accordance with RSA 79, an "Intent to Cut" application must be submitted to the Assessing Department before any timber can be cut from any property within the Alton Town limits. An application may be obtained through the Assessing Department or through the State of New Hampshire Department of Revenue Administration. Further Details can be obtained through the State of New Hampshire tax related statutes, Forest Conservation and Taxation (Chapter 79; Section 10)